- #TSB ONLINE BANKING BUSINESS FULL#

- #TSB ONLINE BANKING BUSINESS ANDROID#

- #TSB ONLINE BANKING BUSINESS SOFTWARE#

- #TSB ONLINE BANKING BUSINESS PASSWORD#

- #TSB ONLINE BANKING BUSINESS PLUS#

The Revenu plan is free for 12 months, with unlimited use. However, users don’t require an accounting platform to collect payments.

#TSB ONLINE BANKING BUSINESS SOFTWARE#

It can also integrate with the popular cloud-based accounting software platforms Sage, Xero, and Quickbooks, allowing fast transaction reconciliation. Revenu can be a great time-saver for business owners by enabling them to streamline their invoicing processes.

#TSB ONLINE BANKING BUSINESS ANDROID#

The app is compatible with both Apple iOS and Android operating systems.

#TSB ONLINE BANKING BUSINESS PLUS#

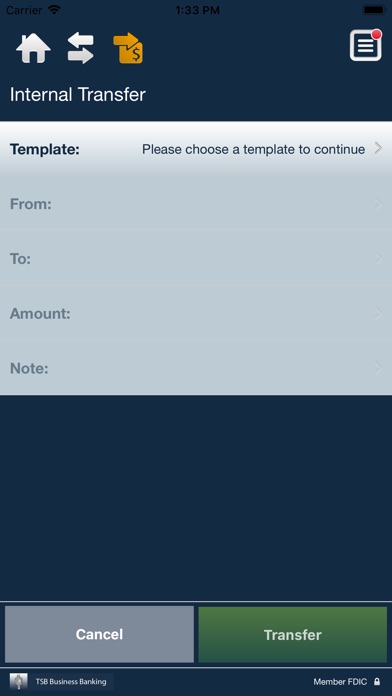

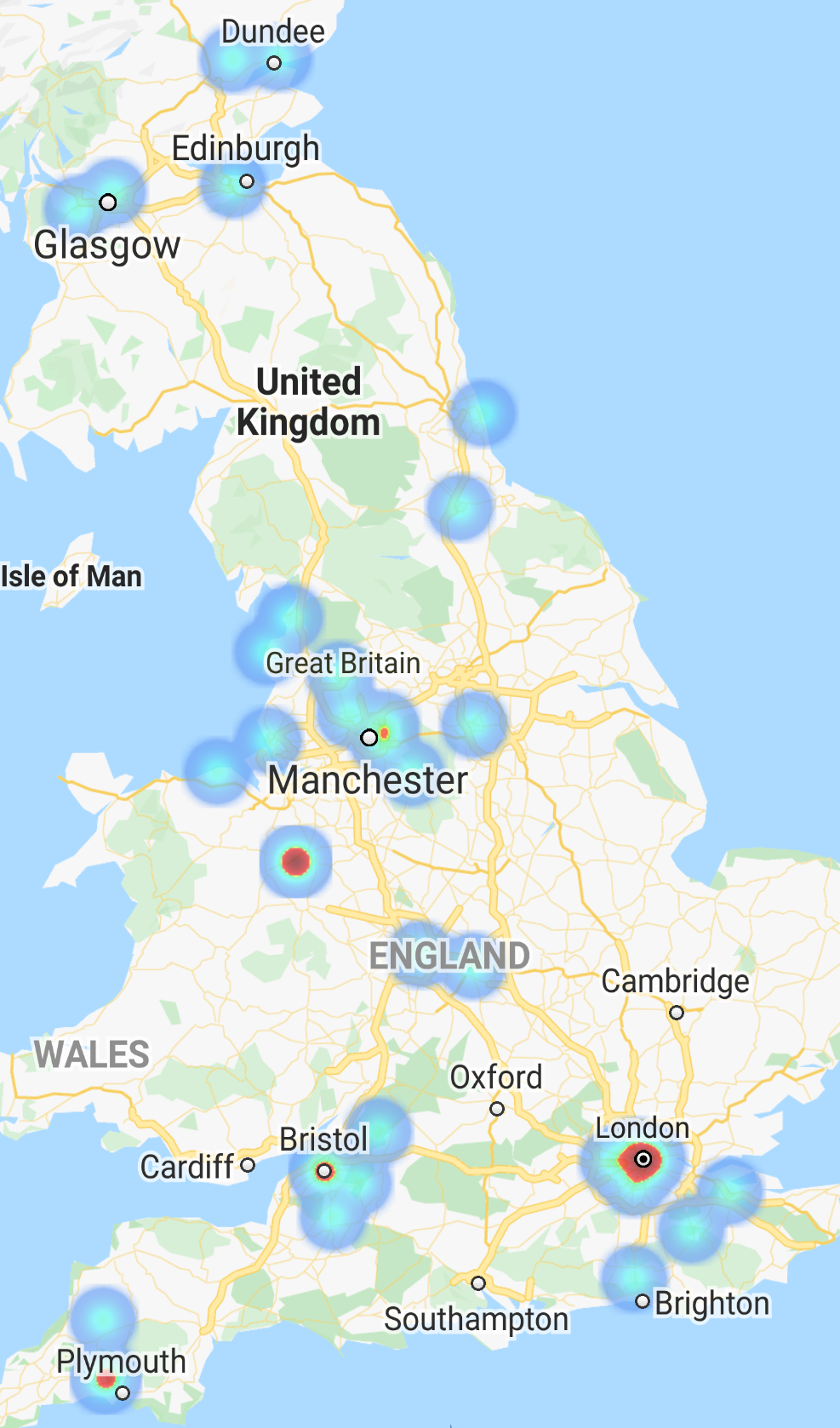

The app links with a user’s Business Plus account, so payments requested via Revenu are deposited directly. The bank’s new payments app, Revenu, uses open banking technology to allow users to collect payments quickly, without having to give account details each time. Since February 2022, TSB Business Plus account holders have been able to request and receive payment via SMS and WhatsApp messages, email, and QR codes. TSB offers the option of opening an interest-paying savings account alongside the Business Plus account. Although not expressly promoted by TSB, accounting software Xero, Quickbooks and Sage all say they can integrate with this business bank account. There are no fees for the first £1,000 of sales. This lets you take chip and PIN or contactless payments on the go from your customers. The card is free to apply for and receive (with no annual fee), plus free to spend on and use for cash withdrawals at ATMs in the UK. You can also deposit cash and cheques at 11,500 Post Office branches. TSB currently operates around 500 branches across England, Scotland and Wales, which you can visit to complete banking transactions or speak to a member of staff in-person. You can check balances and make payments to existing payees in the app, though you’ll need to log in to Internet banking to set up standing orders or add new payees. Manage your account 24/7 online or via the TSB business banking mobile app. But direct debits, other electronic payments and ATM withdrawals are all still free. On the standard tariff there are also some small charges for cheques (70p for each cheque paid into or out of the account) and cash (70p per £100 paid in, out or exchanged). But it’s worth noting that if your business account balance averages above £10,000 over the course of a month, you won’t be charged the £5 fee for that month. When you switch to TSB, you won’t pay any account maintenance fees for 30 months if you keep your account within your agreed limits and avoid being overdrawn without an arranged overdraft.Īfter this free period, you’ll be transferred onto a standard tariff, which includes a £5 monthly fee. TSB offers one type of business account, called Business Plus. Terms and conditions apply. While we don't charge you for downloading our app, you may incur a data charge from your mobile phone operator for downloading and using it.What types of business account are on offer and what are the fees?

#TSB ONLINE BANKING BUSINESS PASSWORD#

We recommend you download and save your eStatements to your password protected personal device to ensure future ease of access. You can access your eStatements anytime and anywhere online through Open24 or in-app on a registered device for a period of 24 months from the statement issue date. To protect your privacy, make sure nobody is looking over your shoulder when you are logging in or browsing your account information. Your account number and PAN are encrypted and we're careful not to display any information that may compromise your security. When you log in to our app, you’ll be asked for your PAN (Personal Access Number). These features include, Branch and ATM Locator, Currency Converter, and help/contact information. Not permanent tsb customer? Don't worry, you can still use features on the app without having to log in. Apply for an Overdraft (existing customers only).Apply for a Credit Card (existing customers only).Access and manage your Cards, including the ability to instantly view or unblock your Visa Debit card PIN (excluding credit cards).

#TSB ONLINE BANKING BUSINESS FULL#

View the full range of features and benefits. Our app offers a range of great features to make accessing your money and controlling your finances easier than ever. It's everyday banking on the go or from the comfort of your home. If you have forgotten your PAN please call 0818 50 24 24 or +353. Please click here if you have forgotten your password, or need a temporary password. You will also require your 6-digit PAN (Personal Access Number) number to login. Your Open24 number is on the back of your permanent tsb Debit Card.

New customers can download the app and create a new current account by tapping Current Account Application from the main screen.Įxisting customers can download the app and login with their Open24 number and password.

0 kommentar(er)

0 kommentar(er)